chances of retroactive capital gains tax

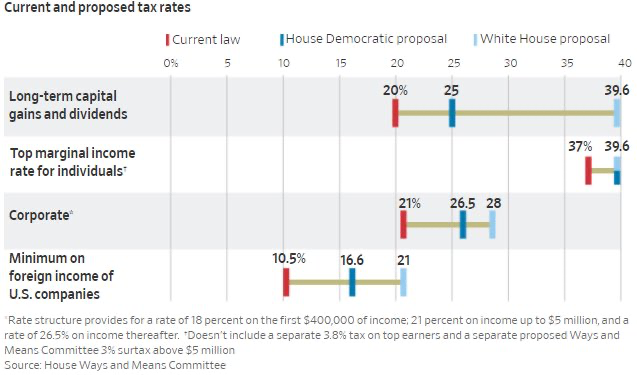

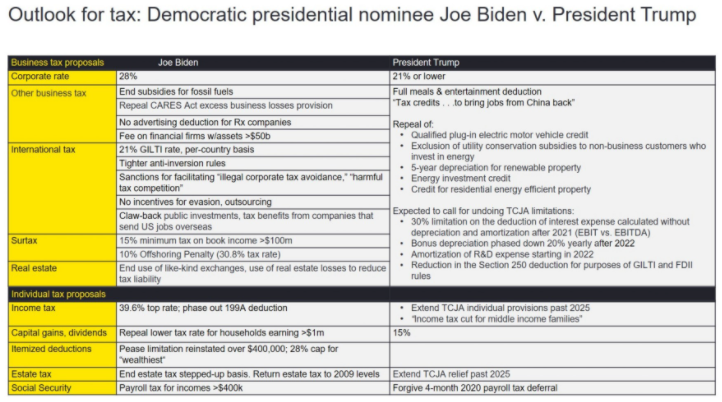

Like I said what would happen is if you know that the cap gains is going from twenty four percent 28 percent whatever it is up to 44 percent. With no tax law changes your client would expect capital gains tax.

Big Tax Hikes Could Lie Ahead Adviceperiod

A Retroactive Capital Gains Tax Increase.

. I dont think make a lot of. If the effective date is retroactive to April 2021 it will be too late for investors to sell to avoid the tax increase. Made permanent the capital gains rate changes in the JGTRRA but provided for a maximum rate of 20 percent.

Even if the capital gains increase is retroactive they would still save money because the capital gains would be based on a 37 marginal tax rate instead of 396. The expectation of this increase resulted in a 40 increase in the. Currently the top capital gain tax rate is 238 percent for gains realized on assets held longer than a year.

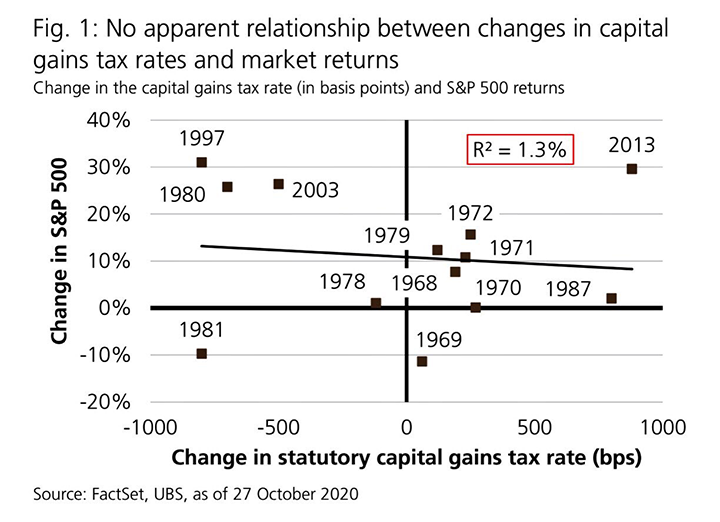

The maximum rate on long-term capital gains was again increased in 2013 from 15 in 2012 to 238 in 2013. Oct26 -- Adam Sender founder of Sender Company Partners SCP discusses how he is positioning ahead of the 2020 presidential election. Bidens pre-election proposal advocated almost doubling the top tax rate on capital gains from the current 20 or 238 including the Medicare surtax to a rate equal to that for.

Maybe then you retroactivity might have made some sense to capture things that were done for purely tax reasons. Donors will be able to give gifts without realization if the estate provisions take effect after 20 See more. Thats a very good chance.

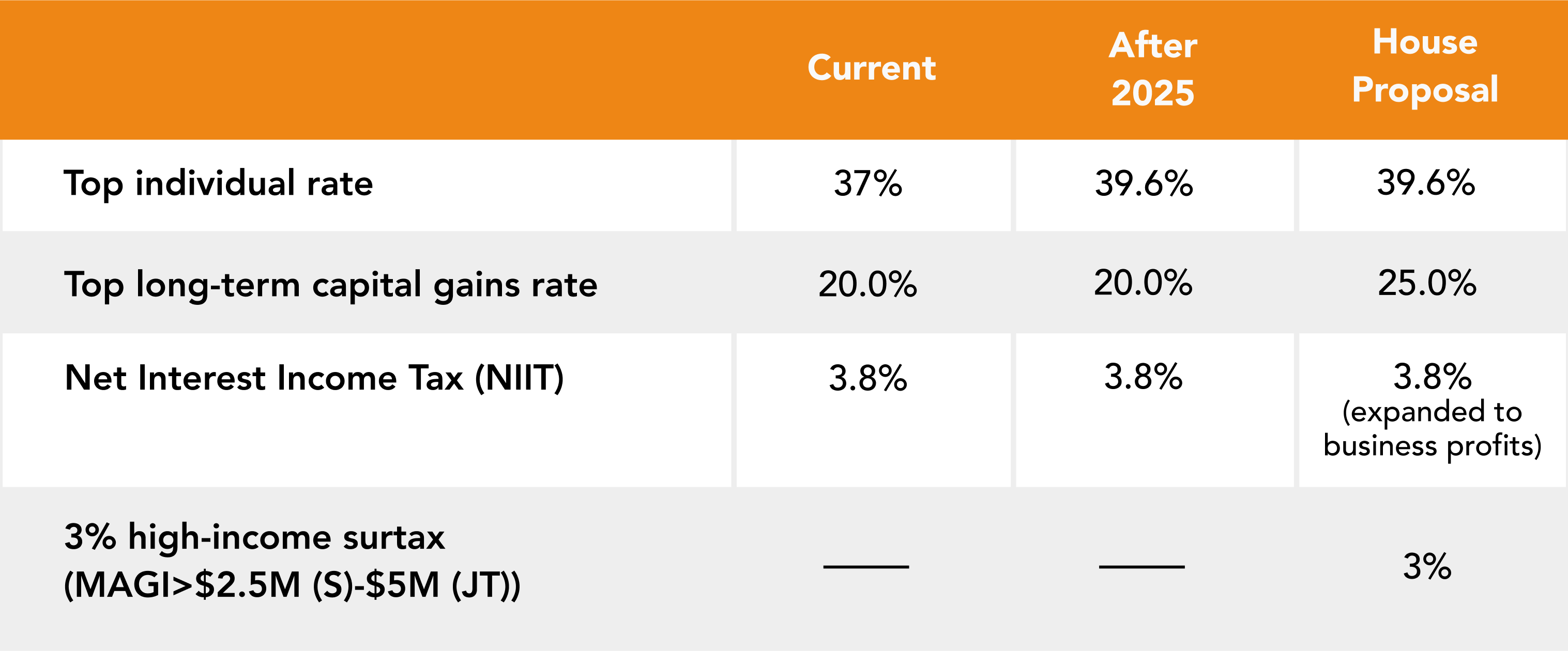

7 rows Introduced 24 July 2012. President Joe Biden released his proposed 2022 fiscal year budget on Friday which calls for an increase of the top capital gains tax rate to 396. Wages can face federal tax of 408 once you include payroll tax but hiking the top 238 capital gain rate to 434 would be a staggering 82 increase.

The proposed tax increase on capital gains may be applied to taxpayers with annualized realized gains over 1 million with those high net families paying a higher tax rate. Signed 2 January 2013. The Presidents proposed 434 capital gain rate is supposed to hit only those earning 1M or more but if you bought a house 30 years ago that is now worth over 1M you.

Biden plans to increase the top tax rate on capital gains to 434 from 238 for households with income over 1 million though Congress must OK any hikes and retroactive effective dates. Absent planning should all be taxed in 2021 the capital gains tax would be 3615000 500000 times 20 plus 9500000 times 37. He speaks on Bl.

But retroactive capital gains taxes. Top earners may pay up to. Biden plans to increase this.

One idea in play is a retroactive capital gains tax increase raising the top tax rate currently 238 percent imposed. Whether or not the capital gains tax increase is retroactive the effects on investing and tax planning could be dramatic.

Reevaluating Dividend Recaps The Time Is Now Article Abl Advisor

Capital Gains Tax Proposal Spurs Car Dealers To Merge Automotive News

Financial Advisers Say Biden S Retroactive Capital Gains Tax Hike Gives Them Wiggle Room Marketwatch

Biden S Tax Plan A Closer Look At 2021 Proposed Tax Changes

Preparing For Tax Hikes Plan But Dont Panic Bny Mellon Wealth Management

Biden S Tax Plan Isn T Fair Will Levy Retroactive Tax On Heirs Harrison County Columns Wvnews Com

Biden Plans Retroactive Hike In Capital Gains Taxes So It May Be Already Too Late For Investors To Avoid It Report Marketwatch

Biden Wants To Nearly Double Capital Gains Tax Here S What That Means

Year End Tax Planning During Uncertain Times Morningstar

In Case Of Capital Gains Tax Hike Don T Panic Thinkadvisor

Taxes Archives Page 2 Of 3 Cd Wealth Management

Proposed Biden Retroactive Capital Gains Tax Could Be Challenged On Constitutional Grounds Foundation National Taxpayers Union

What Are Capital Gains Taxes And How Could They Be Reformed

Accelerating 2021 Business Sales To Avoid Biden Tax Increase

Taxes Archives Page 2 Of 3 Cd Wealth Management

Post 2020 Tax Policy Possibilities Lexology

Higher Taxes May Be On The Way For Wealthy Americans After House Vote

Biden Tax Plan Gets Tossed Into Shredder In Hunt For New Revenue

Capital Gains Tax Hike And More May Come Just After Labor Day